How much tax do you pay in the US? What is the tax rate by the state?

Before you incorporate in the United States, it is better to understand how corporate income taxation works in the United States. Different states in the United States charge different income tax rates in which some of the states do not have any income tax. As you know there is no federal incorporation option available in the United States. In this situation, you may need to know which is the best state for you to incorporate. An understanding of the state-level income tax rate could be a piece of important information to know.

How does corporate income tax work in the United States?

Like most countries in the world, the U.S. imposes a federal income tax on the net profit of the corporation. In addition, the corporation may have to pay state income tax as applicable in that state. Not all states in the United States impose state income tax on the net profit of the corporation.

The net profit of the corporation is derived from its total revenue after deducting “ordinary and necessary” expenses. Net profit can also be defined in a general term as revenue minus, cost of goods sold, selling, marketing, advertising, research and development, operating expenses, and so on. For a detailed list of such deductions from the revenue, please visit our blog, “44-Tax deductible expenses.”

Ordinary and necessary

The term “ordinary and necessary” has been explained by Internal Revenue Services (IRS). An expense is to be considered as a tax-deductible business expense when it is both “ordinary and necessary.” “Necessary” means it is appropriate for the business and not your personal expense or a capital expense. “Ordinary” means it is common and acceptable in your trade and business.

The federal income tax rate

U.S. imposes a 21% federal income tax on the net profit of a C corporation since the Tax Cuts and Jobs Act (TCJA) was signed in 2017 by President Donald Trump. Before this, the corporate federal income tax rate was 35% in the United States. State income tax rate varies from one state to another. However, for computing net income for federal income tax purposes, the corporation is allowed to deduct state income tax, if any, payable on the income.

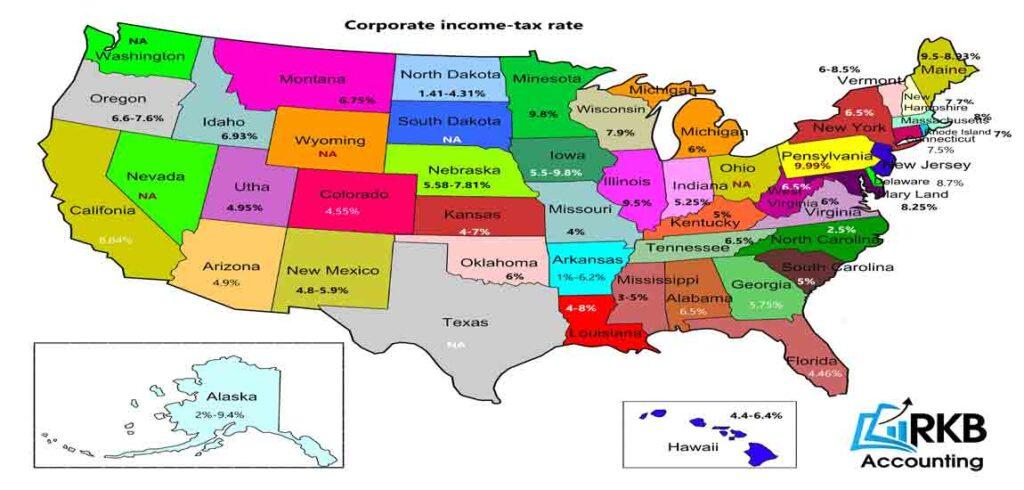

State-wise current corporate income tax rates have been depicted in the following map.

NA – no corporate income tax.

*Updates – scroll down

Retained earnings

After deducting the federal income tax payable and the state income tax payable, from the net profit of the corporation, the after-tax balance of the net profit is added to the “retained earnings” of the corporation. A corporation declares and pays dividends to its shareholders for its retained earnings.

Double taxation

A corporation declares and pays dividends to its shareholders, and the shareholders report that dividend income on their personal income tax return and pay income tax on that again. In other words, a federal/state income tax was already paid on the corporate net profit, and again when the after-tax profit is distributed to the shareholder, a federal/state income tax is collected from the shareholders, resulting in double taxation.

To avoid double taxation many a time, we suggest clients form an S Corporation instead of a C Corporation. An S Corporation does not pay income tax on its net profit. Instead, it distributes its net profit to the shareholders, and only the shareholder is responsible for paying federal/state income tax. An S. Corporation in the United States is considered a pass-through entity for income tax purposes.

However, the US does not allow a non-resident alien to incorporate an S Corporation in the United States. Hence the option left for the non-resident alien is to consider forming an LLC. Please visit our blog “Business Structures/Legal entities” to learn more about types of entities that you can form in the United States or visit our blog “LLC taxation” to know more about tax rules for LLC in the United States.

*Updates

RKB Accounting has expertise in cross-border taxation and has been providing accounting and taxation services for the last fifteen years in Canada and USA. RKB services include incorporating a business on both sides of the border, bookkeeping, sales tax, payroll, and corporate and personal income tax. RKB’s expertise includes cross-border tax planning, long-term tax planning, helping business start-ups, business structure planning, and resolving complex tax matters. RKB a CPA(Delaware), CA(India), and CIA(USA) has over 25 years of experience in accounting and taxation in dealing with various countries in the world.

Disclaimer: Information in the blog/post/article has been presented for a broad and simple understanding. This is not legal advice. RKB Accounting & Tax Services does not accept any liability for its application in any real situations. You need to contact your accountant or us for further information.