Bookkeeping Services

Bookkeeping is the backbone of your business. Capturing data accurately without missing any sources, summarizing, presenting in a meaningful way, maximizing deductible expenses and ensuring your ITC claims, are some of our top priorities.

We are confident in stating that we can save your time and help you to take off bookkeeping from your to-do list. Our customized bookkeeping services ensure accuracy, completeness, easy access, and plausible interpretation of the financial data. We ensure your custom demands are satisfied with the input and professional analysis of our qualified team. Our team of bookkeepers ensures the technical dynamics of accounting rules and guidelines from international financial reporting standards and local GAAP are incorporated into the overall process of accounting and bookkeeping. We intend to serve with the best of our knowledge, professional competence, professional behavior, professional skepticism, and an intact sense of integrity. All businesses are required by CRA in Canada and IRS in the United States to keep accurate records for tax purposes and generally retain your records for six years and three years, respectively.

RKB provides bookkeeping services for small to medium size companies whether doing business in Canada or cross-border. We provide a service tailored to your needs, combining any one or more bookkeeping, GST/HST, Payroll, and management reporting functions, leaving you to take care of running your business. With over 25 years of experience in accounting, we focus on organizing your records, highlighting all costs savings, business development opportunities, optimizing your tax savings, timeliness, complaint, and making you worry-free!

Bookkeeping set up as per client need and reporting requirements

The most important news about our bookkeeping services is that your company does not need to employ, train and manage a bookkeeper and all the expenses to be incurred in the process of employing a bookkeeper can be avoided. Our Professional bookkeeping services allow your business organization to save resources of your business and by just paying an affordable amount of money as a price in exchange for our services for the time we are going to spend working on your business’s books of accounts. Our firm accepts and takes responsibility and accountability for the work done in your books of accounts and you will never find any deficiency in our services.

Bookkeeping Cycle

Before we or you are doing yourself, start setting up your bookkeeping system, need to understand the fundaments and the basics.

Purpose of bookkeeping

Defining and understanding the purpose will help in designing and selecting the right tool for your bookkeeping requirements.

Listing your reporting requirements

Transaction cycle

A business transaction is an event in which your business has created a financial asset or a liability. Understanding the transaction cycle will help to organize the source documents and timely recording.

The flow of your financial transactions and business processes

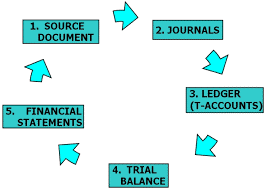

Accounting Cycle

The accounting cycle starts from bookkeeping which is initial recording the transaction and referencing through the document, summarizing and presenting this information in a meaningful way.

Your data flow chart

Financial reports

Our step-by-step approach can take away the enormous burden placed on you by taking care of all your bookkeeping and accounting needs.

Initial set-up

We support bookkeeping services with different accounting software and a manual accounting approach with excel. We support different cloud-based and desktop accounting and bookkeeping software including Quickbooks, Xero, Sage, FreshBooks online and Zoho, etc.

We invest time to understand your business lines like streams of revenue and nature of expenses to create a chart of accounts required for smooth bookkeeping activity. We create and categorize different charts of accounts as per the needs of the business and reporting requirements. If you are an ongoing business, we ensure your chart of accounts is clean and any extra codes are removed from the list of accounts. We ensure the grouping of the codes is accurate and mapping leads to the accuracy of financial reporting.

Business operations

It involves day to management of the accounting and transactions. We have designed a mechanism for the input of double accounting where transactions are posted into the accounting system with the review and approval of the professional accountant. Our team of qualified accountants ensures transactions are posted in the relevant chart of accounts. There is a maker checker rule where due consideration is given to substantive procedures for the review and analysis of supports. Our experts ensure entries are passed on a timely basis to support the matching and other basic accounting concepts.

We further ensure the accounting system works on defined parameters and ongoing bookkeeping tasks like recording sales, purchases, expenses, financing, accounting adjustments, and closing processes are carried on a timely basis. We ensure transaction hits the accounting system once sufficient and appropriate supporting evidence like an invoice from supplier, Receiving notes, Sales invoice, delivery notes, agreement for financing are provided to us, We prefer to carry out the task on the same day we are provided supports to avoid any confusions and unnecessary delay.

Reporting

Financial reports provide comprehensive information about the financial performance and financial position of the businesses. It helps businesses in making strategic decisions and fulfilling regulatory requirements. In today’s dynamic environment, decisions need to be made on an immediate basis to ensure the first-mover advantage. Further, We are living in a world where compliance and regulations are increasing on each coming day. Regulatory challenges mandate businesses to ensure a structured flow of financial information and instant availability. That’s why we ease it by providing desired financial reports in no time. Our services are backed by a structured service mechanism and disciplined teams of professional accountants with relevant qualifications and hands-on experience in the field. We ensure our clients are at ease of doing business by outsourcing their bookkeeping to us rather than managing the accounting department at a higher cost.

Bookkeeping options

This form of bookkeeping is good for service industries, IT contractors where you have one or very few customers and you are either a service provider or you have very few products. We call it the shoebox approach of bookkeeping.

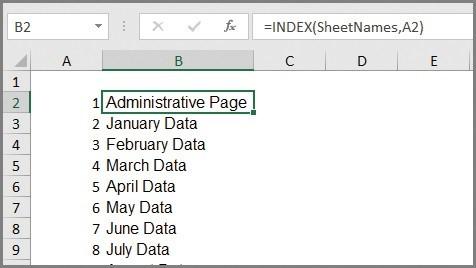

Bookkeeping in MS Excel

Setup your multiple businesses

All the tools you need to save time and confidently run your business

Online accounting software that saves you time and money

Connect your bank and reconcile

Create professional reports in Xero

Businesses can improve cash flow by getting invoices paid faster on Xero. Access to real-time account information and business tools from your Mac, PC, tablet, or phone means greater control and better decisions.

Accounting Software Built for Owners, and Their Clients Balancing your books, client relationships, and business is not easy. FreshBooks gives you the info and time you need to focus on your big picture—your business, team, and clients.

Track your mileage from your phone and update in FreshBooks

Endless options to integrate your strategic departments

Your Life’s Work, Powered By Our Life’s Work Unique and powerful suite of software to run your entire business, brought to you by a company with the long-term vision to transform the way you work.

Small business accounting made easy With Sage Accounting you can automate daily tasks, invoice customers from anywhere, and accept payments online, so you can get paid faster.

Designed for small business

We are pro-advisor or partner with all the above accounting software.

We have a good understanding of many industries such as medicine, sports, franchises, salons, restaurants, and others. We are aware of some variations particular to different industries and this gives us the chance to serve clients across industries.

Basis of accounting

Our Services

Offsite – managed by our team

Accounting Services

Why us?